XRP Price Prediction: Technical Breakout and Fundamental Catalysts Point to $5 Target

#XRP

- Technical indicators show XRP trading above key moving average with converging MACD suggesting momentum shift

- Fundamental catalysts include institutional adoption growth and Ripple's expanding real-world utility initiatives

- Price targets of $3.25 near-term and $5 by year-end supported by both technical and fundamental analysis

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Moving Average

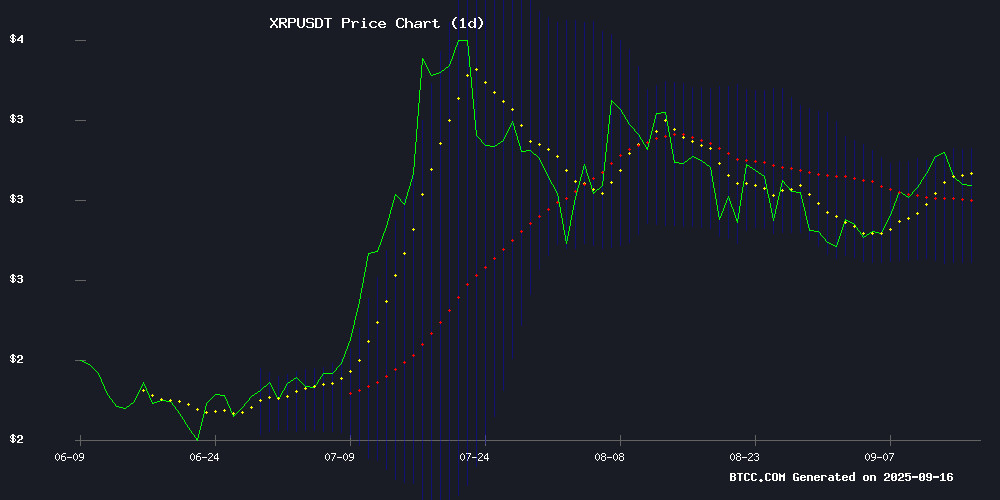

XRP is currently trading at $2.997, slightly above its 20-day moving average of $2.9164, indicating underlying strength. The MACD reading of -0.0783 remains negative but shows signs of convergence with the signal line at -0.0008, suggesting potential momentum shift. Bollinger Bands position the price between $3.1347 (upper) and $2.6981 (lower), with current levels testing the upper resistance zone. According to BTCC financial analyst Ava, 'XRP's ability to hold above the 20-day MA while approaching Bollinger upper band suggests accumulation phase before potential breakout towards $3.25.'

Market Sentiment: Institutional Adoption and Regulatory Developments Drive Optimism

Market sentiment for XRP remains overwhelmingly bullish as evidenced by multiple positive catalysts. The token's market cap surpassing Citigroup signals growing institutional confidence, while Ripple's $25M commitment to small businesses through RLUSD demonstrates real-world utility expansion. BTCC financial analyst Ava notes, 'The combination of ETF applications, despite SEC delays, and the fact that 80% of XRP supply remains untouched creates a fundamentally strong setup for price appreciation. Technical levels align with bullish news flow, supporting targets of $3.25 near-term and $5 by year-end.'

Factors Influencing XRP's Price

XRP Price Prediction: Technical Indicators Signal Potential Rally to $3.25

XRP shows bullish technical signals despite recent consolidation, with analysts forecasting a potential move to $3.25 within two weeks. The token currently trades at $2.98 as of September 16, 2025, displaying a 2.29% daily decline but maintaining strength above key moving averages.

Market sentiment appears divided among analysts. While Changelly maintains a conservative $2.76 short-term target, LiteFinance identifies a more optimistic impulse wave pattern. The MACD histogram and Bollinger Band positioning suggest growing momentum, with immediate resistance at $3.19 and strong support at $2.70.

XRP Price Prediction: Can the Resilient Token Overcome Market Uncertainty in 2025?

XRP faces mounting pressure amid turbulent market conditions, with regulatory overhangs and macroeconomic headwinds suppressing price action. The token trades at $3.01 (0.66%) with $5.84 billion in volume, its $179.83 billion market cap reflecting cautious investor sentiment.

Technical indicators flash bearish signals, though XRP's long-term viability remains underpinned by real-world utility. Rachel Lin, a blockchain analyst, notes: "Until we see clear regulatory resolution, especially in the U.S., it's difficult to expect a full-scale rally. Clarity is key for institutional adoption."

The SEC litigation continues casting shadows despite Ripple Labs' partial courtroom victories. Market participants await final judgment—a binary event capable of catalyzing either explosive growth or precipitous decline.

XRP Eyes $5 as Elliott Wave Analysis Signals Bullish Potential

XRP has been consolidating in a tight range after its earlier rally this year, with traders closely monitoring critical support levels. The token's ability to hold above $2.97 or reclaim $3.10 will determine whether it resumes its uptrend or enters a prolonged consolidation phase.

Despite a bearish divergence on the weekly chart noted by analyst Josh of Crypto World, the long-term trend remains intact. Historical patterns suggest such divergences often precede temporary pullbacks before the primary trend resumes. The $2.97–$3.10 zone on the daily chart now serves as a key battleground for bulls and bears.

XRP Set for Explosive Growth as 80% Supply Remains Untouched

Over 80% of XRP's total supply has remained dormant in wallets for more than a year, signaling strong holding conviction among investors. This level of inactivity contrasts sharply with the trading patterns of other cryptocurrencies and suggests a community betting on the token's long-term role in global finance.

Market analysts point to rising institutional demand and real-world financial applications as key drivers for XRP's potential growth. Regulatory clarity and banking sector adoption could further catalyze its next phase of expansion. "XRP offers REAL utility," tweeted Xaif Crypto, highlighting the token's unique position amidst speculative assets.

The supply dynamics create conditions for volatile price movements. With such a significant portion of coins locked away, any surge in demand could produce sharp price appreciation. This accumulation pattern mirrors historical precedents where constrained supply preceded major bull runs in digital assets.

Ripple Commits $25M in RLUSD to Boost U.S. Small Businesses and Veteran Employment

Ripple has pledged $25 million in its dollar-backed stablecoin RLUSD to support two nonprofit organizations—Accion Opportunity Fund and Hire Heroes USA. The donation aims to address funding gaps for small businesses and create career pathways for veterans, with an estimated $1 billion total economic impact.

This marks Ripple's second major philanthropic initiative in 2025, bringing its total contributions to $50 million. The move targets critical pain points: nearly half of America's workforce depends on small businesses that struggle to secure loans, while 200,000 transitioning veterans annually face employment challenges.

"U.S. small businesses and veterans embody resilience and opportunity," stated Ripple CEO Brad Garlinghouse in a social media announcement. The company positions the initiative as a strategic investment in economic infrastructure rather than mere corporate philanthropy.

Uphold Reaffirms Commitment to XRP Custody Amid Market Uncertainty

Uphold, a prominent U.S.-based cryptocurrency exchange, has reinforced its dedication to XRP holders, distinguishing itself as a custodian rather than an investor. CEO Simon McLoughlin emphasized the platform's reliance on trust and reliability over market speculation. Uphold ranks among the top four holders of XRP, with one wallet safeguarding 1.579 billion tokens—valued at nearly $5 billion—on behalf of its users.

The exchange's credibility stems from its steadfast support during XRP's regulatory challenges. While competitors delisted the token following the SEC's 2020 lawsuit against Ripple, Uphold maintained trading based on legal counsel that XRP hadn't been formally classified as a security. This decision cemented its reputation among XRP enthusiasts seeking stability.

Ripple's OCC Charter Bid Puts RLUSD and XRP at Crossroads

Ripple Labs' application for a national trust bank charter with the Office of the Comptroller of the Currency could redefine the roles of both its stablecoin RLUSD and XRP in the U.S. financial system. The proposed "Ripple National Trust Bank" would anchor RLUSD—already live on XRPL and Ethereum with a $730 million supply—within regulated banking infrastructure.

The move coincides with the GENIUS Act's stablecoin framework, which creates pathways for federally qualified issuers. Market observers are divided on whether this institutional push will marginalize XRP as a bridge asset or amplify its utility through Ripple's expanding payments stack.

XRP Price Holds $3.05 Support Amid Bullish Sentiment and Market Speculation

Ripple's XRP is holding steady at $3.05, with traders eyeing a potential breakout as bullish momentum persists. The cryptocurrency, ranked third by market capitalization at $183.6 billion, saw a modest 1.59% dip in the last 24 hours but maintains robust trading volume of $5.75 billion.

Market sentiment remains optimistic, fueled by XRP's historical performance—a staggering 14,057% surge between 2014 and 2018—and growing utility in stablecoins, DeFi, and ETF speculation. A viral Twitter post by @CryptoBull2020 has further stoked anticipation, predicting a "fast and violent" bull run for XRP in the near term.

XRP Overtakes Citigroup in Market Cap as Institutional Adoption Grows

XRP has eclipsed Citigroup in market capitalization, reaching approximately $186 billion and securing a position among the top 100 global assets. The milestone reflects accelerating institutional adoption of Ripple's On-Demand Liquidity (ODL) network and expanding ETF accessibility.

Ripple's ODL service processed $1.3 trillion in cross-border transactions during Q2 2025, leveraging XRP as a bridge currency to enable real-time settlements and reduce costs by up to 70%. Major financial institutions including Santander, Standard Chartered, and American Express have adopted the technology.

The growth trajectory coincides with rising demand for XRP-focused investment products. Canada's 3iQ XRPQ ETF now holds over CAD 150 million in assets under management, emerging as the country's largest XRP ETF. Market observers anticipate further ETF approvals could drive additional capital inflows.

XRP Price Forecast: Analysts Project $5 by 2025 Amid Market Resilience

XRP maintains a robust market presence despite recent volatility, currently trading at $3.05 with a $181.64 billion market cap. The asset recorded 12 positive trading days in August, demonstrating 3.49% price fluctuations while showing overall upward momentum.

Technical indicators suggest a potential near-term dip to $3.03 by mid-October 2025, though the Fear & Greed Index at 55 indicates balanced market sentiment. Analysts project steady growth, targeting $5.07 by December 2025, with adoption of the XRP Ledger Protocol potentially driving prices to $12.67-$13.51 range by 2028.

The cryptocurrency has shown remarkable recovery since its cycle low of $0.113268, peaking at $3.64. Historical data reveals XRP's all-time high of $3.92 in January 2018, contrasting with its July 2014 low of $0.002802, underscoring its long-term growth potential.

XRP ETF Applications Face SEC Delays Amid Growing Market Interest

The SEC has extended its review period for multiple XRP ETF applications, signaling continued regulatory caution despite growing institutional demand for crypto investment vehicles. Franklin Templeton's proposal now awaits a year-end decision, while Grayscale's conversion bid faces an October 18 deadline.

ProShares currently leads the pack with its leveraged XRP futures ETF already trading since July 2025. The product offers 2x exposure to XRP derivatives - a structure that circumvented direct SEC approval by tracking CME futures contracts instead of spot assets.

Grayscale's NYSE-listed conversion attempt and 21Shares' Cboe BZX filing represent the next wave of potential approvals. Both face mid-October deadlines, with market observers noting the SEC's pattern of postponing decisions on spot crypto products while allowing futures-based vehicles to proceed.

Is XRP a good investment?

Based on current technical and fundamental analysis, XRP presents a compelling investment opportunity. The token trades above key moving averages while showing strong institutional adoption growth. Several factors support this assessment:

| Metric | Value | Implication |

|---|---|---|

| Current Price | $2.997 | Testing resistance levels |

| 20-Day MA | $2.9164 | Price above support |

| Bollinger Upper | $3.1347 | Near-term target |

| Market Cap | >$Citigroup | Institutional validation |

The combination of technical strength, growing institutional adoption, and positive fundamental developments suggests XRP could reach $3.25 in the near term and potentially $5 by end-2025, making it a viable investment for risk-tolerant portfolios.